Recognise Vendor Sales Tactics & Pressure Before They Cost You

Software & SaaS Negotiation Playbooks for IT, Procurement, Finance & Stakeholders

Negotiating software and SaaS contracts requires a structured approach. Software & SaaS negotiation playbooks help IT, procurement, finance, and stakeholder teams recognise vendor tactics — like anchoring, audits, and restrictive bundles — that inflate costs and limit flexibility.

This guide equips CIOs, CTOs, CFOs, procurement leaders, IT teams, and other stakeholders to:

-

Identify common vendor pressure points early in negotiations

-

Model financial and compliance risks

-

Apply Software & SaaS negotiation playbooks to protect budgets and maintain leverage

Want a deeper dive into vendor tactics and actionable playbooks? Scroll to the bottom to access the FREE in-depth Software & SaaS Negotiation Playbook — designed to give IT, finance, and procurement teams practical frameworks to secure better deals.

Why Software & SaaS Negotiation Playbooks Matter

Recognising Vendor Pressure & Control in Software & SaaS Deals

Vendors leverage structured sales frameworks and negotiation tactics to guide buying decisions. Common pressure points include:

-

Anchoring with high list prices to make discounts appear attractive

-

Using audits or compliance reviews to create urgency

-

Bundling products or offering restrictive licensing packages that reduce buyer choice

-

Escalating discussions to executives or legal teams to increase pressure

By recognising these tactics early, buyers maintain leverage, control evaluation milestones, and avoid being locked into unfavourable agreements. According to insights from the Program on Negotiation at Harvard Law School, applying research‑backed negotiation techniques — from framing offers effectively to optimising online negotiation settings — can give buyers a measurable advantage in Software and SaaS deals.

Leverage

Defence

Testing

Flexibility

What You’ll Learn in This Free Guide

Key Buyer Takeaways

Key Buyer Takeaways

This guide provides high-level insights into how Software & SaaS negotiation playbooks can help IT, procurement, finance, and stakeholder teams to:

-

Recognise audit triggers and compliance pressure points

-

Understand key cost drivers and pricing tactics

-

Mitigate risks to IT, procurement, finance, and stakeholders

-

Explore alternative licensing options, including open-source or third-party distributions

Note: Step-by-step frameworks and detailed counter-strategies are available in the private in-depth guide.

Get Your Free Software & SaaS Negotiation Playbook

This free guide equips IT, procurement, finance and stakeholder teams to navigate complex software and SaaS negotiations with confidence.

Inside, you will discover:

- How to recognise vendor tactics that inflate costs or limit flexibility

- Key cost drivers & compliance triggers affecting IT, procurement, finance & stakeholders

- Practical negotiation strategies to protect budgets, reduce risk, and preserve flexibility

- Alternative licensing & sourcing options, including open-source & 3rd-party distributions

- Plain-English explanations of 8 widely-used software & SaaS vendor negotiation tactics

- Common buyer mistakes that software, SaaS, and cloud vendors exploit

- How IT, procurement, finance & stakeholders can prepare countermeasures

ENTER YOUR DETAILS TO ACCESS THE

FREE IT Buyers Guide for Smarter Negotiations

Where This Guide STOPS

This guide focuses on recognition and light counter-moves only. Full buyer playbooks — covering escalation paths, stakeholder alignment, and deal-specific tactics — are delivered as part of advisory engagements.

Next step: If a detailed, vendor-specific Software & SaaS negotiation playbook is required, Engage Delta provides tailored frameworks, coaching, and in-depth scenario modelling for IT, SaaS, and software procurement teams.

Negotiation & Advisory

TECHNOLOGY FOCUSED

73% of enterprises face Oracle Java audit and license risks

Why Oracle Java Audit and Negotiation Options Matter for Your Organisation

Unexpected license fees and compliance challenges are often discovered only during these audits, making proactive negotiation and license management essential for CIOs, CFOs, and IT procurement teams.

Rights Snapshot — Oracle’s No-Fee Terms & Conditions (NFTC)

Oracle’s No-Fee Terms & Conditions (NFTC) permits internal production use for covered JDK versions — but those free updates are time-limited. Redistribution is permitted only if you don’t charge for it. The Oracle “employee-based” Java subscription charges by headcount (not by Java users).

How Academic Studies Inform Oracle Java Audit and Negotiation Tactics

Academic research into audit negotiations shows that factors such as perceived risk, client pressure, and bargaining power directly influence the tactics chosen by each side. As outlined in Oeconomica’s study on negotiation strategies in audit decision-making, understanding these dynamics allows buyers to prepare responses that protect their position and improve their leverage in high‑stakes audits like Oracle Java.

Oracle Licensing History – Java Audit & Compliance Negotiation Options

Oracle’s licensing history shows a familiar pattern: simplify metrics, raise costs, and use audits as leverage. Many CIOs view this as a rinse-and-repeat strategy, where compliance grey areas are interpreted aggressively to maximise fees.

In 2023, Oracle shifted Java from perpetual, processor-based models to an “all-employees” subscription metric. For many organisations, costs rose significantly overnight — and by 2025, this model remains one of the biggest compliance risks in the Java landscape.

Importantly, legacy perpetual licenses still remain valid under their original terms if supported. But Oracle’s No-Fee Terms and Conditions (NFTC) only cover free updates for a limited time: Java 17’s NFTC window ended in September 2024, while Java 21 will be free until September 2026. Beyond those dates, continued updates require a paid subscription.

This isn’t the first time Oracle has reshaped the rules. In the early 2000s, it retired concurrent-user licensing for databases and pushed customers into Named User Plus (NUP) and Processor models. Costs climbed sharply, and audits became a common enforcement tactic.

Two audit flashpoints stood out:

Multiplexing: Middleware, app servers, or connection pooling didn’t shield customers — Oracle argued every end user had to be licensed.

Internet-facing systems: If databases were exposed to the internet (such as customer portals), Oracle claimed “unlimited potential users,” forcing migrations to Processor licenses.

The pattern is clear: Oracle expands definitions of usage to maximise licensing revenue — and now, the same playbook is being applied to Java.

The question for today’s CIOs: are we about to repeat history with Java?

Oracle’s Playbook — Then and Now

Databases (late 1990s → early 2000s)

- Retired 'concurrent-user' metric; phased out by the early 2000s

- Customers could remain on existing 'perpetual concurrent licenses' if usage did not increase

- Migration to NUP/Processor models was required for additional users or processors

- Oracle audits targeted multiplexing and internet-facing systems as compliance leverage

Java (2023 → 2025+)

- Retired NUP/Processor licenses; legacy perpetual contracts remain valid if supported

- “All employees” subscription includes full-time, part-time, contractors, and affiliates

- Oracle audit activity increasing, targeting compliance gaps across mixed legacy & new metrics

Migration Triggers — Employee Subscription May Be Required:

- Additional capacity of NUPs/Processors → triggers migration

- Subscription renewal (non-perpetual) → may trigger employee-based pricing

- Re-platforming or expansions → alters licensing scope

- New Java SE versions required → not covered by NFTC

- Structural organisational changes → exceed legacy entitlements

- Mergers, acquisitions, or divestments → reset licensing definitions & trigger reassessment

Understanding Oracle Java Licensing Changes 2025→

- Legacy NUP/Processor perpetual licenses remain valid while supported

- You are not retroactively forced off legacy perpetual licenses while they remain supported

- Renewals, expansions, added capacity can trigger migration to employee-based subscription

- Audit exposure real; where indirect usage or hybrid environments exceed entitlements

- All-employee pricing under new model includes staff never touching Java - inflates costs

- Java SE subscription - all employees, incl. FT, PT, temps & contractors — not just Java users

This means organisations must prepare for Oracle Java audit and compliance risks while exploring negotiation options before committing to long-term agreements.

Immediate trigger: If you’re running Java 17, your NFTC free-update coverage ended September 2024 — you may already be exposed to audit or support charges. To remain on NFTC without paying, organisations must upgrade production systems to the next LTS release while its NFTC window is valid; non-LTS releases (e.g., Java 18–20) do not extend free-update rights.

Now is the time to take Action

Otherwise Oracle’s audit pressure will dictate your licensing costs

If you haven’t already:

- Audited your Java usage

- Modeled future Java license fees

- Incorporate Java into your SAM strategy

- Explored open-source alternatives like OpenJDK

Oracle Java Audit and Negotiation Options - Unlock the FREE Guide

Prepare your team to navigate Oracle’s shifting Java licensing landscape and negotiate smarter with actionable insights.

Inside, you will discover:

- How to spot Oracle audit triggers and compliance pressure points before they escalate

- The key cost drivers behind Oracle’s 2023 “all employees” subscription model

- Alternative licensing options — including OpenJDK and third-party distributions

- One-page decision tree: stay on NFTC (upgrade cadence) vs. buy employee subscription

- The biggest risks for IT, procurement, and finance when negotiating Java fees

- Practical negotiation strategies to protect budgets, reduce risk, and preserve flexibility

- Step-by-step insights into Oracle Java audit preparation and strategic negotiation options

Oracle’s evolving Java licensing models have created significant cost and compliance risks for enterprises. By understanding Oracle’s audit triggers, subscription cost drivers, and viable alternatives, CIOs, CFOs, and procurement leaders can negotiate from a position of strength.

This free guide equips your team with the insight and practical strategies needed to reduce exposure, protect budgets, and maintain flexibility in a complex Oracle landscape.

NOW IS THE TIME TO TAKE ACTION

FREE Negotiation Guide for Oracle Java Licensing

How Engage Delta Can Help

With over a decade inside Oracle’s strategic sales organisation, Engage Delta brings insight into the tactics, incentives, and pressure points Oracle uses to drive revenue. That experience now benefits CIOs, CTO’s, CFOs, and procurement leaders preparing for Oracle Java negotiations.

With over a decade inside Oracle’s strategic sales organisation, Engage Delta brings insight into the tactics, incentives, and pressure points Oracle uses to drive revenue. That experience now benefits CIOs, CTO’s, CFOs, and procurement leaders preparing for Oracle Java negotiations.

Support includes:

- Reviewing proposals to identify cost and risk exposure including points of leverage.

- Stress-testing negotiation positions to highlight risks and strengthen leverage.

- Providing practical counter-strategies to help reduce costs, limit audit risk, and preserve flexibility.

- Guidance on actionable steps to protect budgets and maximise options.

TECHNOLOGY FOCUSED

Negotiation & Advisory

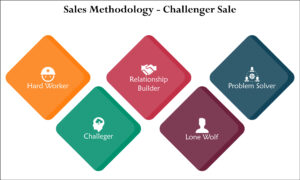

Main Sales Methodologies Used By Top Tech Companies

Software, SaaS, cloud, and other technology vendors don’t rely on chance. They follow structured sales methodologies designed to win new business, expand existing accounts, and capture a larger share of your budget — all covered in Part II of the FREE Buyer’s Guide: Negotiating IT Procurement – Inside the Sales Methodologies Tech Companies Use to Win & Expand.

These strategies go far beyond qualification frameworks — they shape how vendors position themselves, question buyers, and move deals through their pipelines.

This free buyer’s guide reveals the core sales methodologies used by top technology companies — and what they mean for you as a buyer. By recognising these structured approaches, you’ll see how vendors plan every interaction, anticipate your objections, and guide decisions in their favour.

Inside the guide you will discover:

- The most widely used sales methodologies in Software, SaaS, Cloud & IT Infrastructure

- How each method influences problem definition, ROI, and risk perception

- The signals that reveal when a methodology is being applied to your deal

- Where buyers are most at risk of ceding control of scope, urgency, or outcomes

- Practical ways to maintain leverage, balance, and evaluation discipline

Sales Methodologies You'll Encounter When Negotiating IT Procurement

No two vendors apply sales methodologies in exactly the same way. Leading Software, SaaS, Cloud, and IT companies take established frameworks — such as SPIN®, Challenger®, or MEDDICC® — and adapt them to match their internal sales processes, revenue goals, and customer engagement models.

This tailoring allows them to:

- Blend multiple methodologies into a single playbook (e.g., Challenger questioning layered with MEDDICC qualification).

- Align with deal stages in their CRM, ensuring consistency from prospecting through renewal.

- Train sales teams at scale, embedding methodology into onboarding, coaching, and incentive structures.

Reinforce control of the buying process, shaping how problems are defined, solutions are positioned, and ROI is measured. - Continuously evolve their approach based on market changes, competitive pressures, and customer expectations.

- For buyers, this means every interaction is carefully orchestrated to move the deal forward on the vendor’s terms — not yours.

The reality?

Vendors embed these sales methodologies into every stage of the sales cycle as part of their process for negotiating IT procurement—shaping how problems, scope, value, and risk are defined long before final contract negotiation begins.

How Tech Companies Use Structured Sales Methodologies

Forrester research notes that leading tech companies do not leave sales outcomes to chance. They embed structured sales methodologies to manage opportunities consistently and win deals — supported by leadership and reinforced through sales technology to scale adoption.

Forrester research notes that leading tech companies do not leave sales outcomes to chance. They embed structured sales methodologies to manage opportunities consistently and win deals — supported by leadership and reinforced through sales technology to scale adoption.

Industry sources such as SalesforceBen also show how vendors align these methodologies with CRM platforms, ensuring every buyer interaction is tracked, shaped, and steered according to a defined playbook.

In enterprise software, SaaS, cloud, and IT infrastructure, these approaches — from SPIN® Selling and Solution Selling® to Miller Heiman Strategic Selling® and The Challenger Sale® — not only drive new client acquisition but also enable strategic expansion into existing accounts by mirroring evolving B2B buying behaviours.

Included - Negotiating IT Procurement Guide

This free guide equips procurement, IT, legal, and finance teams with practical insights to recognise and counter vendor sales methodologies.

Inside, you will discover:

- How vendors embed structured sales methodologies across the buying cycle

- The risks these approaches create for procurement, IT, legal, and stakeholders

- Key signals that reveal when a methodology is being applied to you

- Plain-English explanations of 13 major sales methodologies

- How top technology vendors adapt these methods to maximise revenue

- Practical countermeasures to maintain leverage and avoid unfavourable terms

Access the guide today and strengthen your position in high-stakes IT, software, SaaS, and cloud negotiations.

ENTER YOUR DETAILS TO ACCESS THE

FREE Buyer's Guide: Recognise Vendor Approaches, Spot Risks & Maintain Leverage

Part I of Engage Delta’s Vendor Sales Tactics Guide

IT vendors often combine strategic sales methodologies with sales qualification frameworks — to guide prospects through the funnel from first contact to final contract.

View [Part I of Engage Delta’s Vendor Sales Tactics Guide] to understand how IT vendors use sales qualification frameworks throughout the sales process.

Negotiation & Advisory

TECHNOLOGY FOCUSED

Ever Felt Like IT Vendors Are Always One Step Ahead In Negotiations?

Large software, SaaS, and cloud vendors rigorously train their sales teams in advanced sales qualification frameworks — such as MEDDPICC®, SCOTSMAN™, and GPCTBA/C&I (covered in Part I of the FREE IT Buyer’s Guide: Vendor Sales Qualification Tactics) — to capture critical buyer intelligence and control the sales cycle.

These methods are designed to:

- Extract budgets, pain points, timelines, key decision-makers, and approval processes

- Identify a “coach” or “champion” inside the buyer’s org. — operative acting as vendor’s agent

- Price-condition buyers through early negotiation tactics

- Create urgency on the vendor’s terms

- Tilt leverage to maximise vendor revenue and margin

Vendor Sales Qualification Tactics - Why Buyers Need a Strategic Guide

Each software, SaaS, cloud & IT vendor adapts these sales qualification frameworks depending on deal values and complexity.

- For example, a low-value SaaS deal may involve only a few interactions — a basic demo and a short negotiation around price, duration & support, where sign-off might happen at the business unit level.

- On the other hand, a strategic ERP deal that underpins data management and operations across an enterprise may last several years, requiring C-level involvement and the CFO as the economic buyer.

Vendors use sales qualification in software, SaaS, and cloud deals to decide whether to invest their time and significant resources. This may involve sales teams, engineers, consultants, travel, and even executive sponsorship. These opportunities feed directly into their CRM forecasts and shape what they communicate to investors regarding future revenues and earnings.

The reality?

Most IT buyers don’t even realise these sales qualification methodologies are in play — download the FREE IT buyer's guide and start negotiating with clarity, confidence, and control.

From BANT to MEDDPICC®: Evolving Sales Qualification Frameworks

Gartner highlights how the classic BANT (Budget, Authority, Need, Timeline) framework helps SaaS sales teams qualify buyers by focusing on financial readiness, decision authority, business need, and timing.

Gartner highlights how the classic BANT (Budget, Authority, Need, Timeline) framework helps SaaS sales teams qualify buyers by focusing on financial readiness, decision authority, business need, and timing.

While BANT remains one of the oldest and most recognised sales qualification methods, it has clear limitations in today’s complex enterprise buying cycles.

The Free Vendor Sales Tactics Guide for IT Buyers explains how qualification frameworks have evolved, why many vendors now favour advanced methodologies such as MEDDPICC®, and how these approaches are used to qualify, influence, and control enterprise deals.

What’s Inside the FREE IT Buyer's Guide?

This free guide helps procurement, IT, legal, and finance teams recognise how global software, SaaS, cloud, and IT vendors use structured sales qualification methodologies to shape buyer decisions.

Inside, you will discover:

- How to recognise 8 major sales qualification methodologies and how they target buyers

- Risks these approaches create for procurement, IT, legal, and stakeholders

- How these methods are applied across software, SaaS, cloud, and IT infrastructure deals

- Common buyer missteps vendors exploit — and how to avoid them

- Practical counter-strategies to protect access, leverage, budgets, and enterprise value

Access the guide today and build stronger negotiating resilience against vendor-driven sales tactics.

ENTER YOUR DETAILS TO ACCESS THE

FREE IT Buyers Guide for Smarter Negotiations

Part II of Engage Delta’s Free IT Buyer's Guide

IT vendors often combine advanced sales qualification methods with strategic sales methodologies — including structured sales processes and discovery techniques — to guide prospects through the funnel from first contact to final contract.

Continue to [Part II of Engage Delta’s Buyer's Guide on Negotiating IT Procurement] for a deeper look at how Tech Companies use strategic sales methodologies.